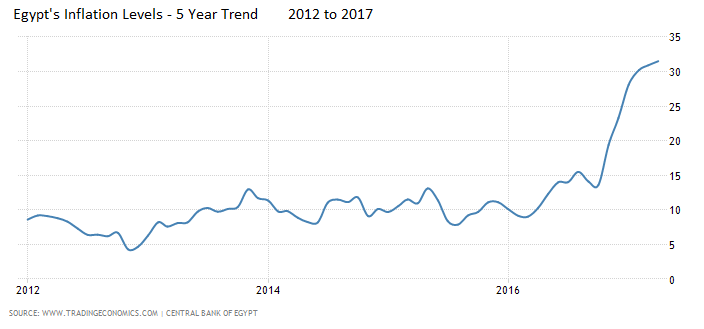

Cairo- Decypha: The inflation rate in Egypt has reached its highest levels since 1986 in February 2017, hitting 30.2%, increasing even further by March to reach 32.5%. The upwards spiral is believed to be mostly due to a weaker currency value that resulted after the floatation of the Egyptian pound (EGP).

Eyeing a $12 billion loan package from the International Monetary Fund (IMF), the economic reform measures taken by the Egyptian government in 2016, such as decreasing in fuel and electricity subsidies, as well as the introduction of the value added tax (VAT), have led to a sharp increase in the cost of living in the Arab world’s most-populous nation.

As for food and beverage prices, they jumped to hit a staggering 43% in March 2017, contributing 22.4% to the total inflation rate. In terms of monthly increase, they have shown an increase of 2% in March, 2.6% in February, and 4.1% in January.

It is noteworthy, however, that month-on-month (MoM) inflation levels have eased from a growth rate of 2.7%in February to only 2.1% in March, according to Minister of Finance Amr El Garhy.

To keep track in its economic reform programme, the IMF has asked the Egyptian government to take some measures to lower inflation rates as well as the budget deficit, Jihad Azour, Director of the fund’s Middle East and Central Asia department told Bloomberg in May.

“Available monetary and fiscal policy instruments, including interest rates, can help to contain inflation,” Azour added.

The Trend: Continuous Inflation Hikes

Egypt’s food market had witnessed continuous hits after the 25 January Revolution in 2011, when the inflation rate reached 11%. After the first presidential elections post the uprising, which resulted in the election of former Islamist president Mohamed Morsi, the inflation rate slowed down to mark 7.4% in June 2012, according to figures issued by the Central Agency for Public Mobilisation and Statistics (CAPMAS).

The mass protests that took place in June 2013 to overthrow Morsi began affecting the market at that time, pushing inflation rates to 9.7% in August 2013.

After that time, the Egyptian government was crippled by a growing budget deficit, which is mainly created by huge amount of public spending. Resolving this, Egypt has introduced fuel subsidies reform in July 2014 through cutting its budget allocations. In that month, the inflation rate hiked to 10.7%.

Discrepancies between the USD exchange rate in the banks and the black market have widened in 2014, when the official rate was EGP 7.83 pounds per USD, and the unofficial rate averaged at EGP 8.2. Low foreign reserves, acted as an additional factor further boosting the negative wave. This had led to higher import prices, pushing inflation up to an average of 10% in 2015.

In efforts to fight the black market, the Central Bank of Egypt (CBE) has devalued the Egyptian pound to 8.88 per USD in March 2016, pushing the inflation rate to 10.3%, to continue surging to reach %16.4 in August 2016.

A month after, Egypt has started application of the VAT, with higher electricity tariffs taking place, which led the World Bank to forecast in October 2016 a higher inflation on the short term, and “negative impact on the poor.”

It was not a long time before the CBE has decided to free-float the local currency in November, moving the official USD exchange rate forward to EGP 13 at once. The inflation rate at that month stood at 20.6%.

Solutions and Opinions

As the high inflation records are expected to influence the market consumption, the World Bank has advised, in its Egypt Economic Outlook published in April, to take a “prudent” monetary policy that can help bring the inflation down.

The IMF, whose mission is currently visiting Cairo to follow-up on the government’s economic reform programme, said in an April statement that the interest rates can be used to curb “one of the highest” inflation rates among emerging markets.

This view is contrary to the opinion of some other analysts, who don’t believe in the effectiveness of interest rates in controlling inflation and consequently the budget deficit, due to the fact that the government is the largest borrower, according to official reports. One of which is Senior Economist at Dubai-based investment bank Arqaam Capital, Reham El Desouki, who told Bloomberg that this will not lower the inflation rates. As the surge has been caused by repeated price shocks as well as base effects relating to the levels of inflation from the previous year. Yet, El Desouki added that inflation rates are expected to gradually dwindle.

Egypt’s Minister of Finance, however, has repeatedly noted in April that the inflationary wave has started to taper-off, other analysts believe it will keep increasing. The VAT percentage is scheduled to rise from 13% to 14% starting from the next fiscal year and the anticipated reforms of fuel prices would further affection the inflation, Head of Prime Holding’s research department, Abu Bakr Imam, told the Daily News Egypt.

Echoing that opinion, Economy Professor at Cairo University, Alia El Mahdy, said that the monetary and fiscal policies should not be conflicting, “raising interest rates would increase the market recession, which is already expected to be affected if the government hiked fuel prices,” she said, according to local media.

Inflation to ease in two years

Influenced by the volatile USD exchange rate, which has taken a current average of EGP18 per USD, the price of imported products has skyrocketed, while the local ones are affected as well due to the imported raw materials and increase in cost of production.

Research houses have expected inflation to remain high this year. UK-based economic research consultancy Capital Economics expected in April that overall inflation to record 29% in 2017, compared to 13.8% in 2016 and 10.4% in 2015.

Forecasting lower inflation levels, FocusEconomics expected inflation to remain at double digits in 2017 and 2018, affected by the expected subsidy cuts, which is part of the government’s economic reform plan.

The anticipated price adjustments would average inflation at 22.3% in 2017, to drop to 13.9% in 2018, FocusEconomics economists stated in April.

On the long-term, the annual headline inflation is expected to ease to a single digit by the end of 2019 or early 2020, Arqaam Capital said in January.

The report, which came after December 2016’s inflation rate jumped to 25.9%, expected the CBE to cut interest rates this year to stabilize inflationary pressures.

While Egypt is undertaking economic reforms to address its growing budget deficit and to improve the investment climate, the state is expected to keep inflation levels under control to protect the most vulnerable citizens through expanding the beneficiaries’ network of its social safety programmes.

By Doaa Farid