Cairo – Decypha: With a youthful population that is increasingly exposed to global trends and technologies, as well as high internet penetration levels, the GCC is perfectly setup for an e-commerce boom. “There is already sufficient infrastructure in place to make the region on the verge of becoming the world’s fastest-growing e-commerce playground,” stated a report by AT Kearney published early 2017 titled GCC E-Commerce Game. To realize this potential, however, several obstacles must be overcome including buyers fearing the idea of making an online purchase, few GCC-based companies offering e-commerce options and government policies that don’t specifically promote e-commerce.

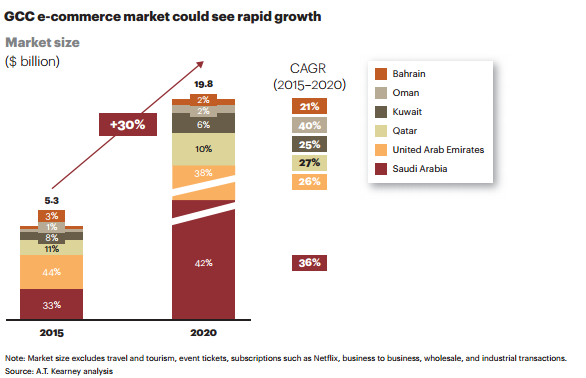

The e-commerce business in the GCC is currently small. In 2015, it accounted for 0.4% of GDP, reaching $5.3 billion, according to the AT Kearney report published in 2017. “[The GCC figure] is really very low,” said Ali Al Khouri, First Deputy Chairman of the Arab Federation for e-Commerce, an intergovernmental body that promotes e-commerce across MENA countries, to Arabian Business in May 2017. Yet, the industry is growing at a rapid pace. It has already grown by 1500% since 2006, according to AT Kearney. In 2017, e-commerce volume should reach $6.7 billion, according to the article. By 2020, e-commerce volume is forecasted to increase four-fold to $20 billion, according to the 2017 AT Kearney report. This is a 30% CAGR growth rate.

Fueling GCC e-commerce

A major factor contributing to this high e-commerce growth rate is the high GDP per capita across the GCC compared to the rest of the world. This translated to a higher level of disposable income to spend on luxury and non-essential purchases. Qatar has the highest GDP per capita in the world at $129,700 as of 2016. Meanwhile, the regions’s average is $69,466 which places it 11th on the list of highest GDP per capita countries for 2016. The GCC also has a high mobile phone penetration of 170% with 65% of the population using smartphones, which access the internet and third party e-commerce applications. Meanwhile, about two-thirds of GCC residents have fixed line internet access at home and at work. The UAE and Qatar are leading the way with 90% of the population having internet access either via fixed line or mobile.

The largest number of e-commerce transactions in the GCC are made by the Emiratis and Saudis, accounting for 77% of all of the bloc’s e-commerce transactions as of 2015, according to AT Kearney. The UAE accounts for 44% of the bloc’s online transactions while Saudi accounts for 33%. Their e-commerce activity grew by 28% and 37%, respectively between 2014 and 2015, according to a report by VISA titled Understanding the Millennial Mindset and What it Means for Payments in the GCC. These growth rates are expected to continue for 2016, according to Kriti Makker, Manager of Visa Performance Solutions for Central Europe, the Middle East and Africa at Visa, talking to El Bawaba in August 2016. The third biggest e-commerce transaction volumes in 2015 came from Qatar (11%) followed by Kuwait (8%), Bahrain (3%) and Oman (1%), according to the AT Kearney report.

Long term growth in e-commerce is assured. A case in point is that 76% and 56% of those born between the early 1980s to early 2000s, have shopped online in the UAE and Saudi Arabia, respectively, according to the VISA report. By 2020, the fastest growing markets will be Oman, growing by 40% over the five year period. It will be followed by Saudi Arabia (36%), Qatar (27%), UAE (26%), Kuwait (25%) and Bahrain (21%), according to the AT Kearney report.

A Ripe Business Opportunity

Despite the positive and sustainable growth trend, few businesses in the GCC are working in e-commerce. “Currently, the e-commerce market is dominated by a handful of players,” said Nick Maclean, Managing Director of commercial real estate services and investment firm CBRE Middle East. By far the biggest in the bloc is Souq.com, established in 2005. During this time it raised $275 million. In 2016, it was sold to U.S. e-commerce giant Amazon for a reported $600 million. At the time, Souq.com had 45 million visits on average every month. It had also opened its first bricks-and-mortar outlet to increase online sales by allowing potential customers to view products before buying them. Also Souq has its own logistics operations in Q-Express to ensure fast deliveries. “Amazon did not come to the region for Souq alone. Amazon came to the region because they saw potential,” Fadi Ghandour, Managing Partner at Wamda Capital and Co-Founder of logistics firm Aramex who handle Amazon shipments to the region, told Arabian Business end of March.

Other major GCC-based e-commerce companies include Namshi, a fashion e-commerce outlet, which raised $35 million since its creation in 2012. It currently has 750,000 customers and features over 50,000 products as reported by AMEInfo in May. MarkaVIP is another fashion online outlet that has raised $20 million.

This landscape is already changing due to the highly positive growth prospects of e-commerce in the GCC. “Rapid growth in the sector and the upward trajectory of local companies has attracted an influx of investment in recent years,” said Maclean. As a result, e-commerce players in the GCC are set to become even fewer as smaller companies look to merge or be acquired by bigger companies. “I think [the Souq.com acquisition] will be the catalyst that gets every major retailer to figure out why their existing e-commerce strategies aren't [working as well as they can],” said Omar Kassim, founder and CEO of e-commerce platform JadoPado, to Arabian Business in March.

Leading that trend towards consolidation is Saudi Arabia’s Public Investment Fund led by Emaar Properties Chairman, Mohamed Alabbar. The Fund is currently creating a $1 billion e-commerce platform called Noon, which focuses on selling high-end fashion online. Yet, instead of starting everything from scratch, the Fund is acquiring existing e-commerce market leaders. In May, they acquired 100% of Jadopado, a direct competitor to Souq.com for an undisclosed amount. They also announced an agreement to buy 51% of Namshi for $151 million. The deal is expected to be completed during the second half of 2017. “The acquisition of a majority stake in Namshi underlines our digital-driven strategy to leverage the growing e-commerce market in the Middle East and North Africa region.” said Alabbar during the announcement. The Fund also entered into a $141.8 million joint venture with Yoox Net-a-Porter, a Milan-based online luxury fashion retailer, which will be launched in 2018. Meanwhile, to ensure one-day delivery Noon will be supported by the Fund’s partial ownership in Aramex.

Challenges

The biggest challenge that any e-commerce business in the GCC regularly faces is the consumers' inherent fear of buying and paying for anything over the internet. In addition to worries over the quality of the bought item, GCC residents worry about writing their financial and residential details on a website without really knowing who views this information. This fear is justified as 40% of online shoppers in the MENA region have been victims of a cybercrime, according to Norton, a company that develops antivirus software. It also said that 71% of the region’s population are aware that such crimes happen.

This helped cement the cash economy across the GCC. In the UAE, 58% of real world and virtual transactions (Pay on Delivery) are in cash while in Saudi Arabia 67% of these transactions are in cash, according to AT Kearney. In the UAE, despite 90% internet penetration, 50% of internet users have never interacted with an e-commerce website, said the AT Kearney report.

As a result, GCC-based e-commerce startups, are having a "hard time managing a successful e-commerce business," said Hamdy Kamal, GIS/IT project management consultant at DMAT in a LinkedIn post published April 2016. Meanwhile, existing bricks-and-mortar retailers are not investing in e-commerce channels or developing a delivery network which allows for 24 hour deliveries such as strategically-locating storage facilities. This has led to expensive shipping, few online-payment options and insignificant attempts at simplifying the online purchasing experience. These limitations further limited online purchasing.

Looking to 2018, the implementation of VAT across the GCC will be a major problem for local e-commerce firms when selling to consumers in other GCC countries. Naturally, the e-commerce firm would pay VAT in its country of origin. However, if it sells beyond the VAT threshold to consumers in another GCC country, the e-commerce firm must register and pay VAT in the consumer's’ home country as well. This is primarily a double taxation problem that should be easily solved on a government level. The negative impact, however, comes from the extra burden and cost incurred by e-commerce startups who will find themselves having to register in all six GCC states, instead of one, to achieve their business targets, according to David Daly, a chartered accountant writing for The National at the end of May.

Government Regulation and Development Efforts

To promote e-commerce, MENA governments have created The Arab Federation of e-Commerce in 2016, which includes representatives from 14 MENA countries. Its main task is to introduce law recommendations, policies and schemes to encourage e-commerce growth throughout MENA. “We are aiming to provide support to the Arab countries as they grow their e-commerce sectors, by ensuring that the right procedures are in place, benchmarked against international practices,” said Khouri, of the Federation in May 2017.

Meanwhile, Dubai Economy has launched a certification for e-commerce websites to assure consumers that they are safe and don’t disclose personal information to third parties. “We will certify e-commerce websites in line with our consumer protection policies and train them on complying with the UAE laws and regulations concerned,” said Mohammed Ali Rashed Lootah, CEO of commercial compliance and consumer protection (CCCP) at Dubai Economy. “The certified websites will display the consumer protection logo of Dubai Economy and cooperate with us in resolving consumer complaints, irrespective of whether they are onshore companies or free zone entities.”

Despite all these efforts, the key to e-commerce realizing its full potential in the GCC; becoming the fastest growing in the world; will ultimately fall into the hands of the retailers and e-commerce businesses who must develop new strategies to overcome the worries of visiting clients when it comes to executing an online transaction. Until then, retailers’ websites will continue to be the doorway to comparing prices, specs and other product features. Meanwhile, the actual purchase decision, will most likely continue to be done at the bricks-and-mortar store.

By Tamer Mahfouz